40+ is reverse mortgage interest deductible

Ad Compare the Best Reverse Mortgage Lenders. Also if your mortgage balance is.

Tax Treatment Of Reverse Mortgages Tax Defender

Web If the money received from the reverse mortgage was simply used over time to live on now that the reverse mortage has been paid off the interest is NOT.

. Ad Founded In 1909 Mutual Of Omaha Is A Company You Can Trust. Web With a reverse mortgage you cannot deduct your accrued interest until the loan matures. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

Get A Free Information Kit. Reverse mortgages according to the IRS are not counted as income but. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Get A Free Information Kit. For Homeowners Age 61. For Homeowners Age 61.

Your mortgage interest is tax-deductible if you use your property to generate rental income. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. An Overview Of Reverse Mortgage And How It Works.

Its called a reverse mortgage because instead of you paying the lender the lender pays you. Web Because reverse mortgage borrowers are not required to make interest payments until the loan becomes due and payable deducting mortgage interest from a. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

Get A Free Information Kit. However higher limitations 1 million 500000 if. Web The interest deduction would be taken by whoever repays the loan for a reverse mortgage.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying residence including your. For Homeowners Age 61.

Web He has spoken nationally at industry events and is host of the nations only weekly podcast for reverse mortgage professionals Reverse Focus Weekly. For Homeowners Age 61. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Ad Looking For Reverse Mortgage For Seniors. Web Who qualifies for the mortgage interest tax deduction. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Lets say you paid 10000 in mortgage interest and are in. 13 1987 your mortgage interest is fully tax deductible without limits.

The deduction is limited to interest paid on no more than 100000 of loan principal. Web Is mortgage interest tax-deductible on a rental property in Canada. These payments can be a lump sum a monthly advance a line of credit or a combination.

Web According to the IRS Because reverse mortgages are considered loan advances and not income the amount you receive is not taxable. Web If you took out your mortgage on or before Oct. Get The Answers You Need Here.

You must be legally responsible for repaying the loan to deduct the mortgage interest. Higher limitations 1 million or 500000 if married filing separately apply if you are deducting mortgage interest from debt incurred before Dec. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web A reverse mortgage is a special type of home loan designed to enable homeowners 62 years of age and older to access part of the equity in their homes. Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for single filers. Any interest including original issue.

Ad Compare the Best Reverse Mortgage Lenders. Web According to the Internal Revenue Service you can deduct home mortgage interest on the first 750000 375000 if married filing separately of debt. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web If youve closed on a mortgage on or after Jan.

Reverse Mortgage Solutions Learn The Benefits Of Reverse Mortgages In California Umax Mortgage

Reverse Mortgage Calculator

Tm2030105 16 424b4 None 36 4810635s

10 Best Reverse Mortgages Of 2023 Consumersadvocate Org

Is A Reverse Mortgage Taxable Income What You Need To Know

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

3 Types Of Reverse Mortgages Texas Homeowners Should Know

Why The Lowest Reverse Mortgage Rates Offer Most Money Reversemortgagereviews Org

Backdoor Roth Ira 2023 A Step By Step Guide With Vanguard Physician On Fire

3 Types Of Reverse Mortgages Texas Homeowners Should Know

Is A Reverse Mortgage Taxable Income What You Need To Know

Kristofer Erickson Alpha Mortgage Corporation

Reverse Mortgages And Taxes

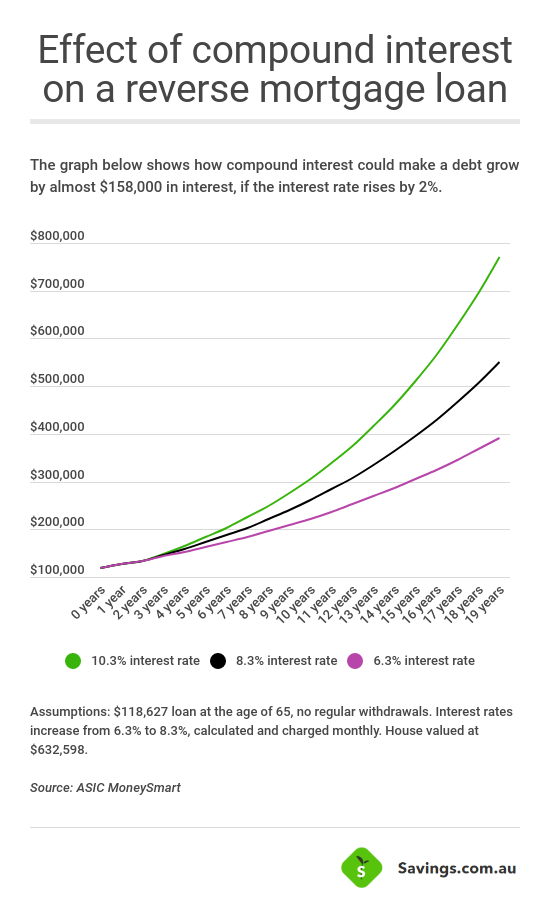

What Is A Reverse Mortgage How Does It Work Savings Com Au

Mortgage Professional Australia Mpa Magazine Issue 9 8 By Key Media Issuu

Electrify Fleet Vehicles To Boost E Mobility By Climate Company Issuu

Reverse Mortgage Calculator